Business exits are often seen as something distant—something you’ll think about when you’re ready to retire. But here’s the truth: every business owner will exit—whether by choice or by circumstance.

As Nicky Goringe Larkin of Goringe Accountants put it:

“The best time to plan your exit strategy is when you start your business. And if you didn’t do it then, the next best time is now!”

It’s not just about retirement. Some people want to sell in order to free up capital, step back for health reasons, or simply move on to a new challenge. And sometimes, life throws curveballs. I’ve seen families left to handle a business after the unexpected death of an owner—on top of everything else they were facing.

That’s why exit planning matters. Not to “check out” of your business, but to give yourself and your family options.

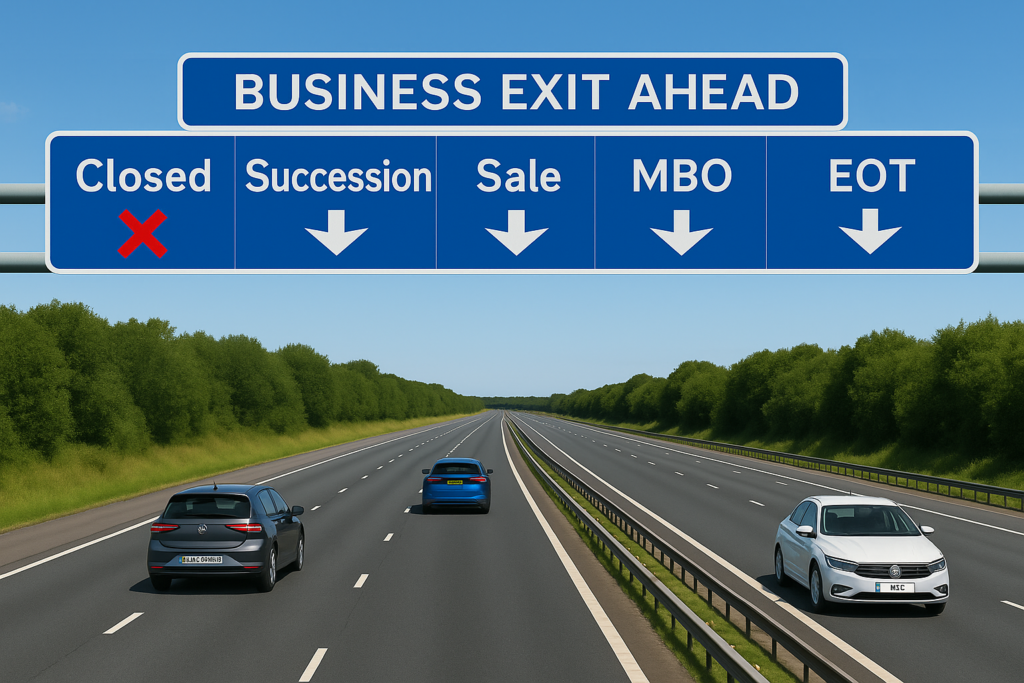

Five common exit routes

When the time comes, most owners choose one of these five paths. Each has advantages, challenges, and very different implications for your legacy, your people, and your finances.

1. Succession by a family member

Many dream of passing the business to the next generation. Done well, it can keep a family legacy alive. But it needs careful preparation: making sure your successor wants the role, is trained for it, and can command respect from the team.

2. Sell to a trade buyer

This is often the quickest way to realise significant value. A trade buyer—perhaps a competitor or a business in a related sector—may pay a premium for your client base, systems, or market position. The challenge? Your business needs to be attractive and able to operate independently of you.

3. Management Buyout (MBO)

In an MBO, your existing management team purchases the business. This can provide continuity for staff and clients and reward loyal leaders. But it requires your team to have both the appetite and the access to funding.

4. Employee Ownership Trust (EOT)

A growing option in the UK, EOTs allow you to sell to a trust on behalf of your employees. They can deliver tax advantages, preserve your culture, and ensure staff buy-in. They also require solid governance and a workforce ready for the responsibility of ownership.

5. Close the business

Sometimes, the best or only option is to wind things up. This might be suitable for smaller businesses or those highly dependent on the owner. While it may not provide the financial return of other routes, it can still be managed well—with planning to protect staff, clients, and your reputation. Closure becomes the default option when planning hasn’t taken place soon enough.

Why prepare early?

Each of these routes takes time. Buyers and successors want strong financials, repeatable systems, and a business that runs without you in the weeds every day. Those qualities can take years to build.

Planning now not only protects your future—it improves your business today: more resilient, less stressful, and ultimately more valuable.

A free valuation for early planners

I’m a certified Value Builder consultant, which means I use a structured process to help business owners increase the value of their companies and prepare for a successful exit.

A full business valuation report normally costs £500—but I’m offering it free to the first five people who request it through this link: (Note, you’ll initially receive an assessment without valuation, and we’ll send through the valuation separately).

Click here for your Value Builder Score >>